Merchant Services: The Ultimate Guide for Small Businesses

Merchant services play a crucial role in modern commerce, as they provide a secure and reliable way for businesses to accept payments from their customers. For small businesses, in particular, having the right merchant services provider can mean the difference between success and failure.

In this comprehensive guide, we will discuss everything small business owners need to know about merchant services, including what they are, how they work, and why they are essential for your business.

What are Merchant Services?

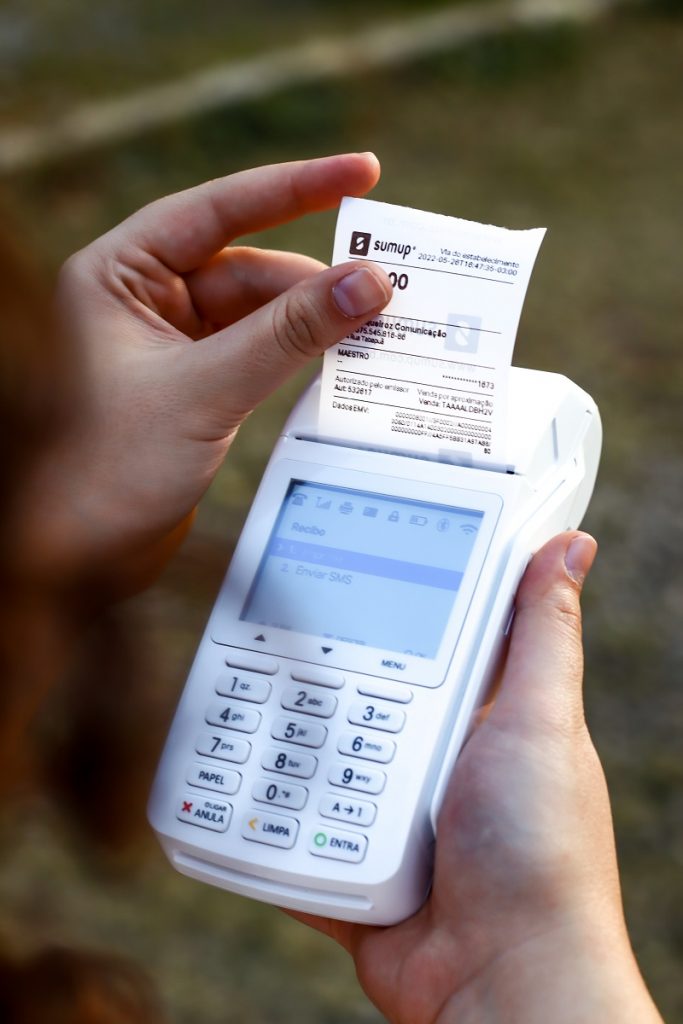

Merchant services refer to a broad range of financial services that allow businesses to accept and process electronic payments. This includes credit and debit card transactions, e-commerce payments, mobile payments, and more.

How do Merchant Services Work?

When a customer makes a payment using a credit or debit card, the transaction is processed through a payment gateway. This gateway is typically provided by the merchant services provider, who charges a fee for each transaction.

The payment gateway sends the transaction information to the customer’s bank or card issuer, which approves or declines the transaction based on the available funds and other factors. If the transaction is approved, the funds are transferred to the merchant’s bank account, minus the transaction fee.

Why are Merchant Services Essential for Small Businesses?

For small businesses, accepting electronic payments is crucial for staying competitive in today’s market. Customers expect to be able to pay with their credit or debit cards, and failing to offer this option can result in lost sales.

Additionally, using a merchant services provider can help small businesses save money and streamline their operations. By consolidating all payment processing into one system, businesses can reduce the need for multiple accounts and minimize the risk of fraud.

Choosing the Right Merchant Services Provider

When choosing a merchant services provider, it is essential to consider factors such as transaction fees, customer support, and security features. Some popular merchant services providers for small businesses include PayPal, Square, and Stripe.

External Links:

- For more information on merchant services fees and pricing models, check out this article from NerdWallet: https://www.nerdwallet.com/article/small-business/credit-card-processing-fees

- To learn more about the benefits of accepting mobile payments, read this post from AllBusiness: https://www.allbusiness.com/mobile-payments-benefits-121707-1.html

Conclusion:

Merchant services are a critical component of modern commerce, and small businesses need to choose the right provider to ensure their success. By understanding the basics of merchant services and considering factors such as pricing and security, small businesses can find a provider that meets their needs and helps them grow.

If you would like more information on how D4 Payments can help you, feel free to reach out!