The Benefits of Mobile Payment Processing for Small Businesses

As more and more consumers turn to mobile payments for their purchases, small businesses can benefit from offering this payment option. Here are some of the benefits of mobile payment processing for small businesses.

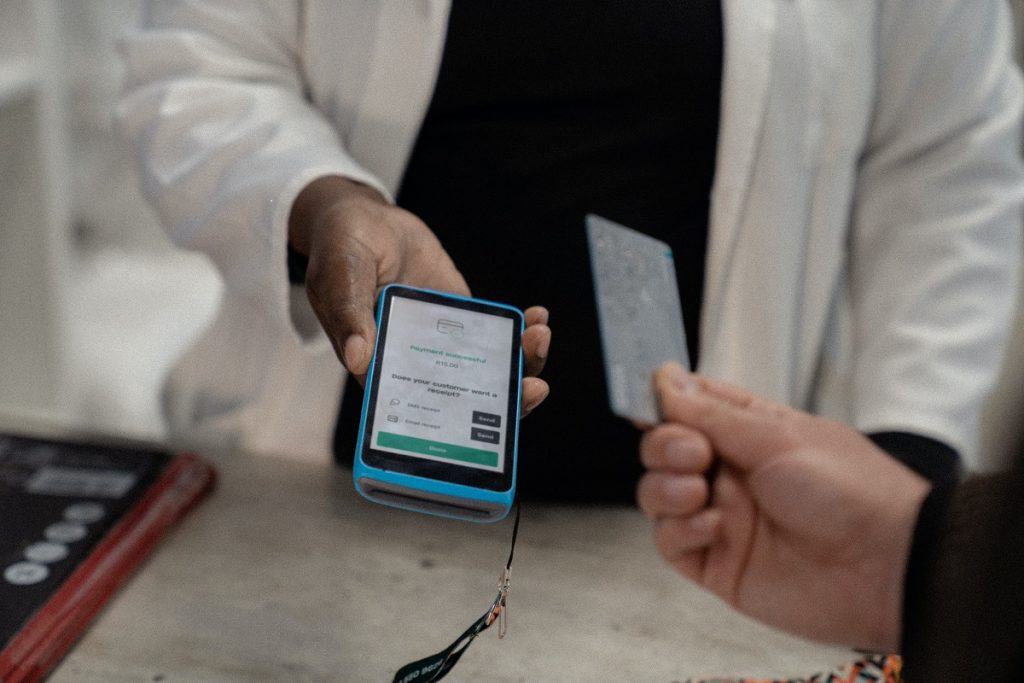

Contactless Payments

Mobile payment processing allows small businesses to accept contactless payments, which can be a significant advantage in today’s world. With the ongoing COVID-19 pandemic, many consumers prefer contactless payment options to minimize physical contact. By offering mobile payment processing, small businesses can meet the evolving needs of their customers and enhance the customer experience.

Convenience and Flexibility

Mobile payment processing offers convenience and flexibility for both small businesses and their customers. Small businesses can accept payments from anywhere, and customers can make payments easily and quickly from their mobile devices. This can be especially beneficial for businesses that operate in remote locations or do not have a traditional brick-and-mortar storefront.

Reduced Transaction Fees

Mobile payment processing can be more cost-effective than traditional payment processing methods. With mobile payment processing, small businesses can reduce their transaction fees and save money on payment processing. This can be especially beneficial for small businesses with low transaction volumes or those that are just starting.

Improved Cash Flow

Mobile payment processing can also help small businesses improve their cash flow. With faster payment processing times, small businesses can receive payments more quickly and avoid delays in cash flow. This can be especially important for small businesses that operate on a tight budget or have seasonal fluctuations in revenue.

Competitive Advantage

Offering mobile payment processing can also give small businesses a competitive advantage. With more consumers using mobile payments, businesses that do not offer this payment option may be at a disadvantage. By offering mobile payment processing, small businesses can attract more customers and stay competitive in today’s digital age.

External Links:

- To learn more about the benefits of mobile payment processing, read this article from Business News Daily: https://www.businessnewsdaily.com/5809-mobile-wallets.html

- To discover the latest trends in mobile payment processing, check out this report from TechCrunch: https://techcrunch.com/2021/04/05/fueled-by-pandemic-contactless-mobile-payments-to-surpass-half-of-all-smartphone-users-in-u-s-by-2025/

Conclusion:

In conclusion, mobile payment processing can offer significant benefits for small businesses, including contactless payments, convenience and flexibility, reduced transaction fees, improved cash flow, and a competitive advantage. Small businesses that offer mobile payment processing can meet the evolving needs of their customers and stay competitive in today’s digital age. By embracing mobile payment processing, small businesses can streamline their payment processing, enhance the customer experience, and focus on growing their business.

If you would like more information on how D4 Payments can help you, feel free to reach out!